Welcome to our comprehensive guide to Key Performance Indicators (KPIs) for software consulting firms! In this fast-paced industry, staying ahead of the competition and delivering exceptional value to clients is essential. This guide will explore the most crucial KPIs that can help you measure, analyze, and optimize your firm’s performance, ensuring sustainable growth and success. From project management and resource utilization to client satisfaction and health of its finances, we’ll dive into the metrics that drive results and provide actionable insights to propel your software consulting business forward. Let’s embark on this journey to unlock your firm’s full potential!

Who is that guide for?

This guide primarily targets professional services organizations and professional services firms that provide IT consulting services such as, but not limited to:

- Software houses

- Software consulting companies

- Software agencies

- IT bodyleasing companies

- Management consulting services firms

- Digital marketing agencies

While to a certain extend other professional service firms might benefit from reading this guide, we will be discussing key metrics for consultants specifically specializing in delivering project-oriented professional services.

What are KPIs for consulting firms?

KPIs for consulting firms are metrics that measure performance, efficiency, and effectiveness in various business aspects. Key indicators include revenue growth, resource utilization rate, billable utilization rate, client satisfaction, client retention rate, project completion time, employee turnover rate, employee engagement, and pipeline growth. These KPIs guide decision-making and help improve overall performance and competitiveness.

Without further-ado, let’s dig straight in.

What KPIs are important in consulting firms?

Important KPIs in consulting companies include billable utilization, which represents the percentage of time consultants spend on revenue-generating activities; project profitability, which monitors the financial success of each engagement; client satisfaction, gauged through feedback and Net Promoter Score (NPS); and employee retention, which is vital in maintaining a skilled and experienced workforce. Additionally, new business development KPIs, such as lead conversion rate and the number of new clients acquired, are essential for monitoring growth and ensuring the firm’s long-term success.

What are the Financial Metrics for professional services organizations?

Every professional services organization needs to keep track of their finances. In today’s fast-paced and competitive software consulting industry, keeping track of financial metrics is crucial for success. This chapter will explore the key metrics used to assess the financial performance of software consulting firms, including net profit margin, billable utilization, client satisfaction, and more. By understanding and leveraging these metrics, firms can optimize their financial wellbeing and achieve better outcomes for both their clients and their business.

Net Profit Margin

The percentage of revenue that remains as profit after accounting for all expenses, highlighting the firm’s profitability and financial management. A higher margin indicates better cost management and greater operational efficiency, which is crucial for maintaining a competitive edge.

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is a financial metric that calculates the average number of days it takes for a software consulting agency to collect payment from its clients after issuing an invoice.

DSO is essential for understanding the efficiency of the firm’s receivables management, cash flow, and overall financial wellbeing.

In the context of software consulting, DSO is particularly important for several reasons:

- Cash Flow: A lower DSO indicates faster collection of receivables, leading to improved cash flow, which is crucial for meeting operational expenses, payroll, and investments in growth.

- Liquidity: Efficient receivables management, reflected by a shorter DSO, helps maintain liquidity and financial stability for the consulting firm.

- Client Relationships: Monitoring DSO can reveal potential issues in client relationships, such as delayed payments, which might require proactive interventions or adjustments in contract terms.

- Risk Management: A high DSO may indicate credit risks or inefficiencies in the billing and collections process, prompting the need for process improvements or stricter credit policies.

By tracking and optimizing DSO, software consulting companies can ensure healthy cash flow, minimize financial risks, and maintain a sustainable and efficient business operation.

At the end of the day, it’s great if a sales team closes a deal, but it’s even better getting paid for your hard work.

Project Profitability

Tracking project profitability is vital for a software consulting firm as it provides valuable insights into the financial performance and efficiency of individual projects. By assessing the difference between project revenues and the associated costs, firms can identify which projects contribute positively to the bottom line and which ones may require optimization. If an indidual project profitability remains low, this could mean the project cost was not estimated well enough, which resulted in suboptimal project margin.

Analyzing project profitability enables better, resource planning and allocation, pricing strategies, and process improvements, ultimately leading to higher overall profitability. Well understanding the project margins is key .

Operating Cash Flow (OCF)

Operating cash flow (OCF) represents the cash generated from a consulting company’s core business operations, excluding investments and financing activities. It reflects the firm’s ability to generate cash through delivering services to clients, while accounting for expenses like employee salaries, rent, and other operational costs. OCF is a vital metric because it provides insights into the company’s financial wellbeing and sustainability.

For consulting companies, maintaining a positive operating cash flow is crucial for several reasons:

- Solvency: Adequate cash flow ensures that the firm can meet its financial obligations, such as paying employees, vendors, and covering other operational expenses.

- Stability: A consistent positive cash flow indicates a stable and sustainable business model, which can boost investor confidence and enhance the firm’s reputation.

- Growth: Positive operating cash flow enables the company to invest in business expansion, such as hiring new talent, pursuing new projects, or investing in marketing and business development efforts.

- Flexibility: A healthy cash flow provides flexibility to navigate unexpected challenges or seize new opportunities that may arise.

- Risk management: Monitoring operating cash flow helps identify potential financial risks and take proactive measures to address them.

This metric is exceptionally important with connection to the distribution of your income. If the revenue resulting out of billable hours for one concrete client is higher than the OCF, this could mean losing the client could lead to insolvency.

Average Revenue (Profit) per FTE

How much revenue per hours billed. Low value could expose inefficiency of the whole sales pipeline process, highlighting that sales pipeline is selling below the cost to achieve. A low value could also be a result of severe project overrun, or not enough billable team members.

The importance of Average Revenue (Profit) per Full-Time Equivalent (FTE) for an IT consulting agency lies in its ability to measure the revenue or profit generated by each team member. This metric helps assess the efficiency and productivity of the workforce, revealing the company’s overall operational performance. A higher value indicates better resource utilization and effective cost management. By monitoring and optimizing Average Revenue per FTE, IT consulting companies can identify areas for improvement, allocate resources more effectively, and enhance their profitability, ensuring sustainable growth and competitiveness in the market.

Employee Satisfaction

The level of commitment and motivation among employees, which can influence productivity, innovation, and overall business performance.

Employee satisfaction in software consulting contributes to project efficiency and client success. When employees are happy and engaged, they’re more likely to excel at their tasks, actively serving clients with dedication and expertise. Fostering a positive work environment enhances productivity and promotes long-term company growth.

Employee turnover rate

The rate at which employees leave the firm, reflecting employee satisfaction, engagement, and the firm’s talent management capabilities.

Team’s productivity Metrics

In today’s fast-paced and competitive software consulting industry, measuring team productivity is crucial for success. This chapter will explore the key metrics used to evaluate the efficiency and effectiveness of software consulting teams, including velocity, cycle time, lead time, and more. By understanding and leveraging these metrics, teams can optimize their performance and achieve better outcomes for their clients.

Resource Utilization Rate

Optimizing resource utilization is crucial for maximizing profitability and delivering exceptional value to clients. The resource utilization rate is a key performance indicator (KPI) that measures how effectively a consulting firm allocates its most valuable asset – its workforce. This metric, expressed as a percentage, compares the actual billable hours of consultants to the total available hours, providing insights into the efficiency of the firm’s staffing strategy.

A higher utilization rate indicates better alignment of resources with client projects, contributing to increased revenue and overall business success. Conversely, a low utilization rate may signal underutilized talent, potential employee dissatisfaction, and decreased profitability, indicating the efficiency of resource allocation and staff deployment.. By closely monitoring and managing resource utilization, consulting firms can strike a balance between maximizing billable work and avoiding employee burnout, ultimately fostering a thriving and sustainable business.

Key points:

- Resource utilization rate is calculated as the ratio of hours worked to the total available hours

Billable Utilization Rate

Often shortened as just billable rate. As they say in the Big4, a billable consultant is a good consultant. As a service provider we should be working towards maximizing this number as it displays proper efficient use of human resources.

The average number for financially healthy organizations would be 80%.

The billable rate is the most important metric for every as it’s change greatly influences the annual revenue of the company.

Key points:

- Calculated as the ratio of billable hours worked to the total available hours

- Should oscillate around 80% for financially sound professional services organizations

Customer satisfaction

Customer satisfaction is a vital metric for consulting companies, as it reflects the quality and effectiveness of their services. By gauging client feedback and using tools like Net Promoter Score, firms can identify strengths and areas for improvement. High customer satisfaction leads to repeat business, positive referrals, and a strong reputation, ultimately contributing to long-term growth and success in the competitive consulting industry.

A consulting company can increase revenue recognition and client satisfaction by:

- Understanding client needs and tailoring services accordingly.

- Communicating clearly and transparently throughout projects.

- Delivering quality work on time.

- Setting realistic expectations and being proactive.

- Building strong relationships and seeking feedback.

- Providing excellent post-project support and investing in the team.

Client retention rate

Client retention rate is a KPI that a professional services firm may use to measure the percentage of clients who continue to do business with the firm over a specific period, typically a year. It helps assess the consulting company’s ability to maintain and nurture long-term relationships with its clients, reflecting the quality of services provided, customer satisfaction, and overall business stability. A high client retention rate indicates that the firm consistently meets or exceeds client expectations, while a low retention rate may signal potential issues, such as poor service quality, lack of communication, or strong competition in the market.

On-Time Project Completion Rate

The On-Time Project Completion Rate is a crucial performance indicator for consulting companies, as it measures the percentage of projects completed within the agreed-upon timeframes. This metric is essential for several reasons:

- Client satisfaction: Timely delivery of projects demonstrates professionalism and reliability, fostering trust and positive relationships with clients.

- Resource management: Efficient project completion helps optimize resource allocation, enabling the firm to take on more projects and generate additional revenue.

- Reputation: A strong track record of on-time project completion enhances the company’s reputation, potentially attracting new clients and referrals.

- Cost control: Delays can result in cost overruns, negatively impacting profitability.

- Competitive advantage: Effective time management distinguishes a consulting company from its competitors, contributing to long-term success.

Planned vs. actual hours spent

And when talking, how often as a professional services firm have you promised a client to deliver until a date, either scheduled billable hours or proposed a fixed price, just to learn that what you committed to is not deliverable within the provided time constraints? That’s no shame at all.

While IT and software consulting services estimation tends to be one of the most challenging, the client should always be aware of any project cost overruns and should be informed well in advance, in case you spot that the estimation was unrealistic. That’s why tracking this key performance indicator is so vital.

Theres no client that would like hearing that the project will cost more. But even worse is hearing that when we already spent all the resources allocated!

Tracking of this metric is strongly recommended, regardless if the consulting firm acts only on T&M or decides to primarily offer projects on a fixed price.

Repeat business rate

This metrics mostly signals and works in strong correlation with customer churn and customer satisfaction. Its calculated as the percentage of qualified leads that not only converted but resulted in subsequent new engagements. This is a metric higlighting how loyal are your clients. On average companies report 65 percent of their total revenue coming from repeat clients.

In IT consulting professional services itself, this is one of the key performance indicators, measurement of which is not always necessary or helpful. This is especially valid if the professional services company in question, has multiple clients that they have a continuous relationship with on one concrete project such as with bodyleasing professional services firms.

Sales Teams Metrics

In the dynamic and highly competitive world of sales, measuring team performance is vital for achieving revenue goals and staying ahead of the competition. This chapter will delve into the key metrics used to evaluate the effectiveness and efficiency of sales teams, including lead conversion rates, pipeline velocity, win rate, and more. By utilizing these metrics, sales teams can optimize their strategies and processes, increase revenue, and deliver exceptional value to customers.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost is a key metric that quantifies the total expenses incurred by service organizations to acquire a new client. It includes marketing, sales, and specific costs related to administrative expenses associated with attracting, engaging, and converting prospects into paying customers.

CAC is crucial for evaluating the efficiency and effectiveness of client acquisition strategies, helping firms optimize their marketing and sales efforts, control costs, and improve overall profitability. A lower CAC indicates a more cost-effective approach to acquiring clients, while a higher CAC may signal a need to reevaluate and refine the organization’s client acquisition tactics if it does not correlate with the total revenue obtained from an average client.

As a rule of thumb CAC needs to be at least three times client lifetime value, for a company to be considered profitable.

Conversion rate

A critical metric for professional services companies as it measures the proportion of leads or prospects that become actual clients or signed billable resource contracts. This rate is important for several reasons:

- Efficiency: A high conversion rate reflects the effectiveness of the firm’s marketing and business development strategies in turning potential clients into paying customers, thus utilizing resources more efficiently.

- Revenue growth: By converting more leads into clients, consulting companies can boost revenue and increase their market presence.

- ROI: Monitoring helps evaluate the return on investment (ROI) of marketing and sales efforts, enabling firms to optimize their strategies and allocate resources to the most successful channels.

- Competitiveness: A strong rate indicates that the consulting firm is successfully conveying its value proposition and differentiating itself from competitors in the market.

- Client acquisition: Understanding and improving the rate can help identify potential barriers or bottlenecks in the client acquisition process, leading to more targeted efforts and better results.

In summary, the conversion rate is vital for consulting companies as it directly impacts revenue generation, business growth, and market competitiveness. By focusing on improving this metric, firms can optimize their client acquisition strategies, leading to increased success and sustainability. A low value of this key metric could subsequently suggest inefficiencies in the sales pipeline.

Customer Churn rate

Customer retention is the the percentage of clients who continue to do business with the firm over a concrete period, signifying the firm’s ability to maintain long-term relationships.

Sales Growth Rate

Sales growth rate is a key performance indicator that measures the percentage increase in revenue generated by a professional services firm over a specific period, such as quarterly or annually.

It provides insights into the firm’s financial situation, market presence, and the effectiveness of its business development efforts. A positive growth rate indicates that the company is successfully acquiring new clients, retaining existing clients, and expanding its services. Conversely, a stagnant or declining sales growth rate may signal potential issues, such as increased competition, pricing challenges, or client dissatisfaction.

Monitoring sales growth rate helps consulting companies identify trends, adapt strategies, and drive sustainable business growth.

What are the vanity metrics in consulting?

There are also some examples of metrics, tracking of which would be a waste of time if they are used as sole metrics, rather than looking at their correlation with other metrics.

With the amount of data available, sometimes consulting firms might feel tempted to track everything but it’s rarely best to overwhelm yourself with a large amount of key performance indicators that don’t necessarily broaden the perspective. Let’s jump right in!

Monthly website traffic

Monthly website traffic is a vanity metric for professional service firms as it only indicates the number of visitors without measuring the quality of those visits or the actual business outcomes. High traffic may seem positive, but it doesn’t necessarily result in new clients or revenue. Instead, focusing on metrics like conversion rate, lead quality, and engagement can provide a more comprehensive understanding of a firm’s online performance and impact on the bottom line.

Instead use: Lead conversion rates, project profitability, and client retention

Number of current clients

The number of clients is a vanity metric in professional service firms because it doesn’t reflect the quality or profitability of those clients. Having a large client base may seem impressive, but it doesn’t guarantee financial success or client satisfaction. Instead, focusing on metrics like client retention, revenue per client, and project profitability provides a more accurate picture of a firm’s overall performance and long-term viability.

Instead use: Revenue recognition

Visits per channel

Visits per channel is considered a vanity metric for IT consulting companies because it focuses on the number of website visits or engagements without providing insights into the actual business outcomes or client relationships. While higher visits per channel might suggest increased brand awareness, it does not necessarily translate to better lead conversion, client satisfaction, or revenue generation. In the IT consulting industry, where project-based engagements and long-term relationships are crucial, focusing solely on visits per channel could be misleading. It is more beneficial to track actionable metrics, such as lead conversion rates, project profitability, and client retention, to gain a comprehensive understanding of the company’s key performance indicators.

Instead use: Lead conversion rates, project profitability, and client retention

Leads generated

Leads generated is considered a vanity metric in consulting because it focuses on the number of potential clients without accounting for their quality, the likelihood of conversion, or the actual revenue generated. A high number of leads may look impressive, but it does not guarantee successful engagements or increased profits.

Instead use: Conversion rate

Cost of Salaries Share

The total cost of salaries share is not a valuable metric for a professional services firm to track because it does not provide any meaningful insights into the company’s performance. The reason is that the software consulting industry is highly specialized, and the skills and expertise required to deliver projects can vary widely. Therefore, the cost of salaries can differ significantly depending on the level of experience, seniority, and complexity of the project.

Focusing on the total cost of salaries share alone can be misleading, as it fails to take into account other factors that impact the company’s profitability, such as the utilization rate of employees, the efficiency of project delivery, and the quality of customer satisfaction.

Instead use: Revenue per billable hours

Gross Margin Rate

Gross margin rate, in the context of a consulting business, is the percentage of revenue that remains after deducting direct costs, such as consultant salaries and project expenses. It reflects the firm’s financial efficiency and profitability, indicating how much money is available to cover operating expenses and generate profit.

Instead use: Net profit margin

Average hourly fee

While tracking your average hourly rate might be tempting to see where is your professional services company positioned among other consulting firms, this metric proves to be mostly a vanity key performance indicator.

The average hourly fee can be considered a vanity KPI for IT consulting companies because it may not accurately reflect the overall health, efficiency, or profitability of the business. While a higher hourly rate might seem impressive, it does not take into account other crucial factors such as billable utilization, project complexity, or the quality of the services provided. A company with high average hourly fees could still struggle with low client satisfaction or poor resource allocation, which could ultimately affect the bottom line.

Instead use: Average revenue per FTE

Project completion time

The time it takes to complete a project from initiation to delivery, indicating the efficiency of the firm’s project management processes. While for an occassional consulting firm that offers repetible consulting services such as WordPress landing pages, online stores, this metric could prove valuable to track, the majority of software consulting companies’ projects will differ significantly in project completion or might never be completed due to continuous maintainance nature of building software products.

Instead use: Planned vs. actual hours spent

Cycle Time

Refers to the duration it takes to complete a specific task, process, or project within the software development lifecycle. This metric is used to measure the efficiency and effectiveness of the consulting team’s project management, development processes, and collaboration. This is a vanity metric because depending on the nature of work your professional services company takes on, this will differ significantly. The majority of software projects are non-repetible and differ substentially. In fact tracking this metric could lead to decreased employee happiness as employees could feel their efforts are misjudged. This could however prove an interesting key performance indicator if the company delivers boxed solutions such as WordPress or Drupal landing pages that on average take about the same to deliver/test regardless of the client. Reportedly, management consulting firms also tend to keep their engagements at 3 months.

Final thoughts

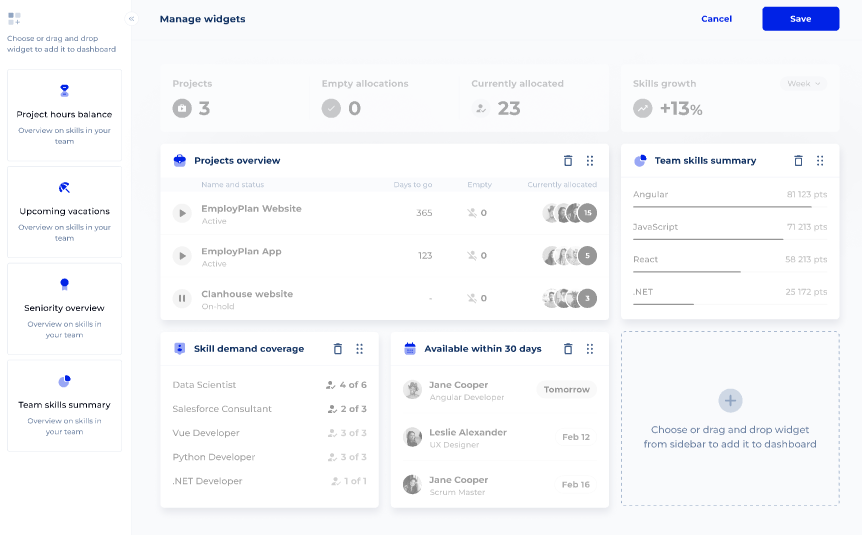

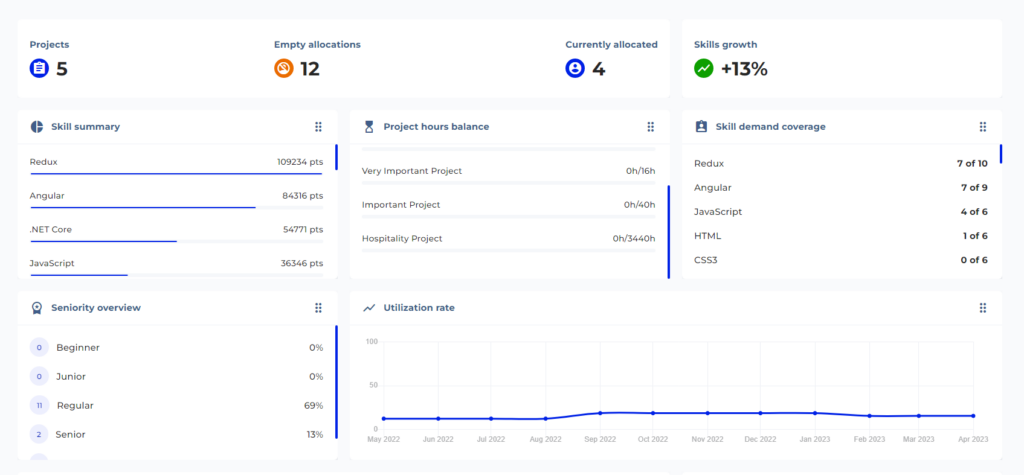

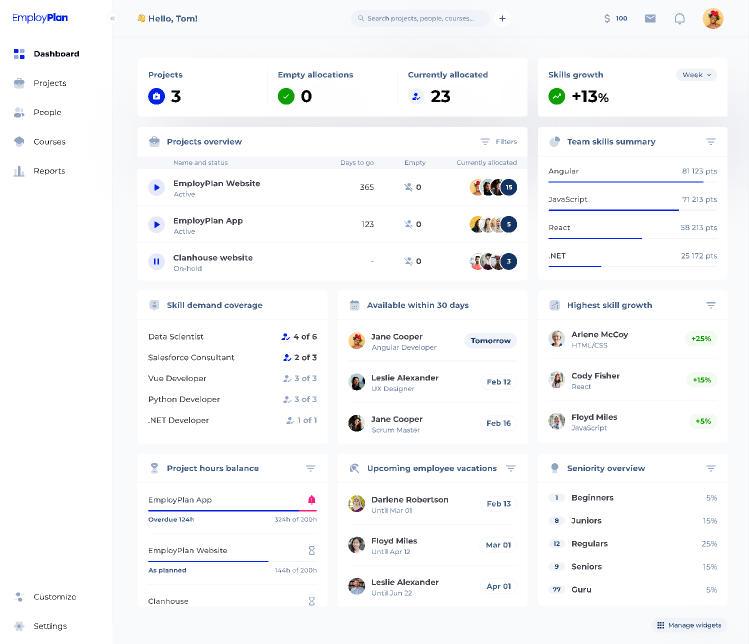

In conclusion, key performance indicators are crucial in monitoring the success and growth of professional services firms. EmployPlan offers a powerful solution to track your company’s metrics with its customizable dashboard. By planning engagement within EmployPlan, you can efficiently manage billable hours, monitor company’s revenue, and ensure the financial health of your business. The platform helps prevent project overruns and enables you to make informed decisions for continuous improvement. Don’t miss the opportunity to elevate your firm’s performance by leveraging EmployPlan’s innovative features, designed to keep your finger on the pulse of your company’s progress. Try out free today!